Topaz Limited Partnerships

How They Work

Limited Partnerships (LPs) are a time-tested investment vehicle that Topaz has refined to offer our investors unique opportunities in real estate. Our approach combines traditional LP structures with modern best practices to deliver value and transparency.

NOTES

Contact Us Directly

Investment Process

- Project Selection: We carefully analyze potential projects to ensure they align with our investment goals and objectives.

- Structuring: Upon deciding to move forward, we create an LP and invite investors to participate.

- Capital Allocation: Typically, investors contribute 20% of the capital, while Topaz provides 80%, though this may vary by project.

- Roles: Topaz serves as the General Partner (GP), managing the investment, while investors are Limited Partner Investors (LPIs).

- Ownership: The LP is divided into shares, with profits, losses, and tax advantages distributed proportionally.

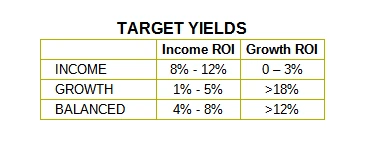

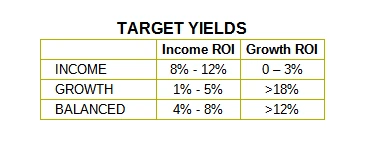

Investment Objectives

We offer three types of investment objectives:- Income: Focuses on generating regular monthly income, similar to bonds or annuities

- Growth: Aims for returns primarily through property appreciation

- Balanced: Seeks both income generation and value appreciation

Targeted Yields

Our stated returns are projections based on thorough analysis and market expertise. While not guaranteed, we often exceed these targets. We have never fallen below our targets. Detailed explanations of our return expectations are provided in each LP's Offering Memorandum.

NOTES

- We've never underperformed these target yields.

- These are minimum yields. If your LP is not pursuing these yields or greater, you should put your money in an S&P 500 Index Fund.

Key Considerations for Limited Partners

Advantages:- Limited liability (risk is capped at the investment amount)

- Potential for higher returns compared to traditional investments

- Passive investment opportunity for busy professionals

Risks and Limitations:

- Higher risk profile than some traditional investments

- Limited liquidity (typical 5-7 year investment horizon)

- Passive role in property management decisions

Distributions and Reporting

- Quarterly profit distributions (monthly for income-focused LPs)

- Annual K-1 or K-2 tax forms provided

- Electronic fund transfers with email notifications

- Comprehensive monthly reports and document access via electronic file folders

Topaz Difference

We maintain a conservative, time-tested approach to LPs, prioritizing investor interests and long-term success. Our track record of stability and profitability sets us apart in the industry. Important: Consult with a qualified investment advisor before investing. While LPs offer significant opportunities, they also carry risks, including potential loss of principal.Contact Us Directly